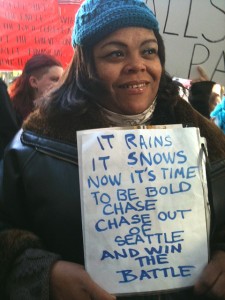

One of Seattle's breaker-uppers

On November 5th, all across the country 99%ers were breaking up with the big banks.

I spent last weekend in Seattle visiting Occupy Seattle, a feisty group of Washingtonians gathered in Westlake Park across the street from Chase Bank and next to Bank of America to tell their stories of their disappointment in the shabby treatment they’ve gotten after the big Bank bail out.

Between shouts of “They got bailed out. We got sold out”, folks got up on stage to tell their stories of excessive monthly fees, bogus overdraft fees, home foreclosures and joblessness.

What is particularly appalling for Seattleites is the role of Chase bank and its CEO Jamie Dimon, who makes $10,000/hour since taking over the Washington-based bank Washington Mutual (WaMu).

What is particularly appalling for Seattleites is the role of Chase bank and its CEO Jamie Dimon, who makes $10,000/hour since taking over the Washington-based bank Washington Mutual (WaMu).

The bank was incorporated in the 1800s after the great Seattle fire destroyed much of the central business district of the city. Since then it was the largest savings and loan association, that is until its collapse in 2008. All WaMu branches were rebranded as Chase branches by the end of 2009 and the first thing they did in Washington state was to lay off 3400 workers.

Another Seattle woman done with her banking relationship

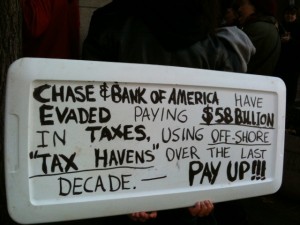

Now Chase has upped the fees it charges account holders and even started charging fees on the use of the food stamp electronic card, despite the fact that it receives millions of tax dollars to administer the state’s food stamp program.

Susan Wilkinson got up and talked about why she joined the vocal 99%. She had just completed her 99th and last week of unemployment benefits, after working for 25 years. With her home foreclosed and bankruptcy declared, she announced that it was time to stop feeling bad about herself and start reclaiming her dignity. “It’s not me, it’s you” she said to Chase bank as she urged us all to break up with the big banks.

Susan wrote an opinion piece that appeared in her local paper The Seattle Times on 11/4/11:

“I view the vast economic disparity that has mushroomed over the past 30 or so years as deadly: deadly to our most vulnerable citizens, deadly to our country and deadly to democracy itself. I cannot stand idly by while vast numbers of people find themselves homeless, without medical care, or unable to feed themselves or their families. To close my eyes to this crisis would be cowardice, and after 99 weeks, I’ve nothing left to lose.”

We gathered outside the glass doors of Chase bank while account holders went inside one-by one to close their accounts and shred their debit cards. We cheered as they announced that 8.5 million dollars had been withdrawn from Chase that day.

We gathered outside the glass doors of Chase bank while account holders went inside one-by one to close their accounts and shred their debit cards. We cheered as they announced that 8.5 million dollars had been withdrawn from Chase that day.

If you want help moving your money to a credit union or local bank check out these resources.

Or encourage your city or state to open its own bank that is controlled democratically. Now there’s a good idea and it can be done. North Dakota has one!

Or encourage your city or state to open its own bank that is controlled democratically. Now there’s a good idea and it can be done. North Dakota has one!