Reposted from Senator Bernie Sander’s new Report, “Meet the Wall Street and Corporate Tax Dodgers“:

On February 7, 2013, Senator Bernie Sanders is introducing legislation to crack down on Wall Street and corporate tax avoiders that are avoiding tens of billions in taxes every year by shifting profits to the Cayman Islands and other tax havens. Rep. Jan Schakowsky (D-IL) is introducing the companion bill in the House.

Chart: Jason Easley, PoliticsUSA

The Business Roundtable represents some of the largest Wall Street and corporate tax avoiders in the country. Recently, the Business Roundtable came out with a plan to raise the eligibility age for Medicare and Social Security to 70, cut Social Security and veterans’ benefits, and increase taxes on working families.

Many of the corporations and Wall Street banks represented by the Business Roundtable have:

- avoided more than $128 billion in taxes by setting up over 500 subsidiaries in the Cayman Islands, Bermuda, and other offshore tax havens since 2008;

- received more than $6.5 billion in tax refunds from the IRS, after making billions in profits;

- outsourced hundreds of thousands of American jobs to China and other low wage countries, forcing their workers to receive unemployment insurance and other federal benefits; and

- received a total taxpayer bailout of more than $2.5 trillion from the Federal Reserve and the Treasury Department and nearly caused the economy to collapse over four years ago.

Instead of cutting Social Security, Medicare, Medicaid, and veterans’ benefits, it is time for these corporate and Wall Street tax dodgers to pay their fair share in taxes and bring jobs back home to America.

Here are just a few examples of how the corporations and Wall Street banks these CEOs work for have significantly harmed our economy and the federal budget:

1. Bank of America CEO Brian Moynihan

Number of Offshore Tax Havens in 2010? 371.

- In 2010, Bank of America operated 371 subsidiaries incorporated in offshore tax havens. 204 of these subsidiaries are incorporated in the Cayman Islands, which has a corporate tax rate of 0%.

- Amount of federal income taxes Bank of America would have owed if offshore tax havens were eliminated? $2.5 billion.

- Bank of America has stashed $18.5 billion in offshore tax havens to avoid paying U.S. income taxes. Bank of America would owe an estimated $2.5 billion in federal income taxes if its use of offshore tax avoidance was eliminated.

- Amount of federal income taxes paid in 2010? Zero. $1.9 billion tax refund.

- Bank of America received a $1.9 billion tax refund from the IRS in 2010, even though it made $4.4 billion in profits.

- Taxpayer Bailout from the Federal Reserve and the Treasury Department? Over $1.3 trillion.

- During the financial crisis, Bank of America received a total of more than $1.3 trillion in virtually zero interest loans from the Federal Reserve and a $45 billion bailout from the Treasury Department.

2. JP Morgan Chase CEO James Dimon

Number of Offshore Tax Havens in 2010? 83.

- In 2010, JP Morgan Chase operated 83 subsidiaries incorporated in offshore tax havens.

- Amount of federal income taxes JP Morgan Chase would have owed if offshore tax havens were eliminated? $4.9 billion

- JP Morgan Chase has stashed $21.8 billion in offshore tax haven countries to avoid payng income taxes. If this practice was outlawed, it would have paid $4.9 billion in federal income taxes.

- Taxpayer Bailout from the Federal Reserve and the Treasury Department? $416 billion. During the financial crisis, JP Morgan Chase received a total of more than $391

- billion in virtually zero interest loans from the Federal Reserve and a $25 billion bailout from the Treasury Department, while Jamie DImon served as a director of the New York Federal Reserve.

3. Goldman Sachs CEO Lloyd Blankfein

Amount of federal income taxes paid in 2008? Zero. $278 million tax refund.

- In 2008, Goldman Sachs received a $278 million refund from the IRS, even though it earned a profit of $2.3 billion that year.

- Number of offshore tax havens in 2010? 39.

- In 2010, Goldman Sachs operated 39 subsidiaries in offshore tax haven countries.

- Amount of federal income taxes Goldman Sachs would have owed if offshore tax havens were eliminated? $3.32 billion.

- Goldman Sachs has stashed $20.63 billion in offshore tax haven countries to avoid payng income taxes. If this practice was outlawed, it would have paid $3.32 billion in federal income taxes.

- Taxpayer Bailout from the Federal Reserve and the Treasury Department? $824 billion.

- During the financial crisis, Goldman Sachs received a total of $814 billion in virtually zero interest loans from the Federal Reserve and a $10 billion bailout from the Treasury Department.

4. General Electric CEO Jeffrey Immelt

Number of offshore tax havens? At least 14.

- GE has at least 14 tax haven subsidiaries in Bermuda, Singapore, and Luxembourg for the purpose of avoiding U.S. income taxes.

- Amount of federal income taxes General Electric would have owed if offshore tax havens were eliminated? $35.7 billion.

- GE has stashed $102 billion in offshore tax haven countries to avoid paying income taxes. If this practice was outlawed, it would have paid $35.7 billion more in federal income taxes.

- Amount of federal income taxes paid in 2010? Zero. $3.3 billion tax refund. In 2010, not only did General Electric pay no federal income taxes, it received a $3.3 billion tax refund from the IRS, even though it earned over $5 billion in U.S. profits.

- Taxpayer Bailout from the Federal Reserve? $16 billion.

- During the financial crisis, the Federal Reserve provided GE with $16 billion in financial assistance, at a time when Jeffrey Immelt was a director of the New York Federal Reserve.

- Jobs Shipped Overseas? At least 25,000 since 2001.

- Since 2001, General Electric has closed more than 30 manufacturing plants in the United States, cut 34,000 American jobs, and added 25,000 jobs overseas. General Electric now has more workers abroad than it does in the United States.

- On December 6, 2002, Jeffrey Immelt, the CEO of General Electric, said at an investor’s meeting: “When I am talking to GE managers, I talk China, China, China, China, China. You need to be there. You need to change the way people talk about it and how they get there. I am a nut on China. Outsourcing from China is going to grow to $5 billion. We are building a tech center in China. Every discussion today has to center on China. The cost basis is extremely attractive. You can take an 18 cubic foot refrigerator, make it in China, land it in the United States, and land it for less than we can make an 18 cubic foot refrigerator today, ourselves.” -Jeffrey Immelt, Chairman, CEO of General Electric, quoted at an investor meeting on December 6, 2002.

5. Verizon CEO Lowell McAdam

Amount of federal income taxes paid in 2010? Zero. $705 million tax refund.

- In 2010, Verizon received a $705 million refund from the IRS despite earning $11.9 billion in pre-tax U.S. profits.

- Amount of federal income taxes Verizon would have owed if offshore tax havens were eliminated? $525 million.

- Verizon has stashed $1.5 billion in offshore tax havens to avoid paying U.S. income taxes. Verizon would owe an estimated $525 million in federal income taxes if its use of offshore tax avoidance was eliminated.

- American Jobs Cut in 2010? In 2010, Verizon announced 13,000 job cuts, the third highest corporate layoff total that year.

6. Honeywell International CEO David Cote

Amount of federal income taxes paid from 2008-2010? Zero. $34 million tax refund.

- From 2008 through 2010, not only did Honeywell pay no federal income taxes, it received a $34 million tax refund from the IRS, even though it earned over $4.9 billion in U.S. profits during those years.

- Amount of federal income taxes Honeywell would have owed if offshore tax havens were eliminated? $2.835 billion.

- Honeywell has stashed $8.1 billion in offshore tax havens to avoid paying U.S. income taxes. Honeywell would owe an estimated $2.835 billion in federal income taxes if its use of offshore tax avoidance was eliminated.

7. Merck CEO Kenneth Frazier

Amount of federal income taxes paid in 2009? Zero. $55 million tax refund.

- In 2009, not only did Merck pay no federal income taxes, it received a $55 million tax refund from the IRS, even though it earned more than $5.7 billion in U.S. profits.

- Amount of federal income taxes Merck would have owed if offshore tax havens were eliminated? $15.5 billion.

- Merck has stashed $44.3 billion in offshore tax haven countries to avoid paying income taxes. If this practice was outlawed, it would have paid $15.5 billion more in federal income taxes.

8. Corning CEO Wendell Weeks

Amount of federal income taxes paid from 2008-2010? Zero. $4 million tax refund.

- From 2008 through 2010, not only did Corning pay no federal income taxes, it received a $4 million tax refund from the IRS, even though it earned nearly $2 billion in U.S. profits during those years.

- Amount of federal income taxes Corning would have owed if offshore tax havens were eliminated? $3.78 billion.

- Corning has stashed $10.8 billion in offshore tax havens to avoid paying U.S. income taxes. Corning would owe an estimated $3.78 billion in federal income taxes if its use of offshore tax avoidance was eliminated.

9. Boeing CEO James McNerney, Jr.

Amount of federal income taxes paid in 2010? None. $124 million tax refund.

- Boeing, which received a $30 billion contract from the Pentagon to build 179 airborne tankers, got a $124 million refund from the IRS in 2010.

- Amount of federal income taxes Boeing would have owed if offshore tax havens were eliminated? $66 million.

- Boeing would owe an estimated $66 million more in federal income taxes if its use of offshore tax avoidance was eliminated.

- American Jobs Shipped overseas? Over 57,000.

- Since 1994, more than 57,000 Americans lost their jobs at Boeing as a result of overseas outsourcing or rising imports.

- Amount of Corporate Welfare? At least $58 billion.

- Boeing received over $58 billion in taxpayer-subsidized loans and loan guarantees from the Export-Import since 1994.

10. Microsoft CEO Steve Ballmer

Amount of federal income taxes Microsoft would have owed if offshore tax havens were eliminated? $19.4 billion.

- Microsoft has stashed over $60 billion in offshore tax haven countries to avoid paying income taxes. If this practice was outlawed, it would have paid 19.4 billion more in federal income taxes.

11. Qualcomm CEO Paul Jacobs

Amount of federal income taxes Qualcomm would have owed if offshore tax havens were eliminated? $5.8 billion.

- Qualcomm has stashed $16.4 billion in offshore tax haven countries to avoid paying income taxes. If this practice was outlawed, it would have paid $5.8 billion more in federal income taxes.

12. Caterpillar CEO Douglas Oberhelman

Amount of federal income taxes Caterpillar would have owed if offshore tax havens were eliminated? $4.55 billion.

- Caterpillar has stashed $13 billion in offshore tax havens to avoid paying U.S. income taxes. Caterpillar would owe an estimated $4.55 billion in federal income taxes if its use of offshore tax avoidance was eliminated.

13. Cisco Systems CEO John Chambers

Amount of federal income taxes Cisco would have owed if offshore tax havens were eliminated? $14.455 billion.

- Cisco has stashed $41.3 billion in offshore tax havens to avoid paying U.S. income taxes. Cisco would owe an estimated $14.455 billion in federal income taxes if its use of offshore tax avoidance was eliminated.

14. Dow Chemical CEO Andrew Liveris

Amount of federal income taxes Dow Chemical would have owed if offshore tax havens were eliminated? $3.5 billion.

- Dow has stashed $10 billion in offshore tax havens to avoid paying U.S. income taxes. Dow would owe an estimated $3.5 billion in federal income taxes if its use of offshore tax avoidance was eliminated.

15. Alcoa CEO Klaus Kleinfeld

Amount of federal income taxes Alcoa would have owed if offshore tax havens were eliminated? $2.9 billion.

- Alcoa has stashed $8.3 billion in offshore tax havens to avoid paying U.S. income taxes. Alcoa would owe an estimated $2.9 billion in federal income taxes if its use of offshore tax avoidance was eliminated.

16. Stanley Black & Decker CEO John Lundgren

Amount of federal income taxes Stanley Black & Decker would have owed if offshore tax havens were eliminated? $1.26 billion.

- Stanley Black & Decker has stashed $3.6 billion in offshore tax havens to avoid paying U.S. income taxes. They would owe an estimated $1.26 billion in federal income taxes if its use of offshore tax avoidance was eliminated.

17. Motorola Solutions CEO Greg Brown

Amount of federal income taxes Motorola Solutions would have owed if offshore tax havens were eliminated? $350 million.

- Motorola Solutions has stashed $1 billion in offshore tax havens to avoid paying U.S. income taxes. They would owe an estimated $350 million in federal income taxes if its use of offshore tax avoidance was eliminated.

18. Tenneco CEO Gregg Sherill

Amount of federal income taxes Tenneco would have owed if offshore tax havens were eliminated? $269 million.

- Tenneco has stashed over $698 million in offshore tax haven countries to avoid payng income taxes. If this practice was outlawed, it would have paid $269 million in federal income taxes.

19. Express Scripts CEO George Paz

Amount of federal income taxes Express Scripts would have owed if offshore tax havens were eliminated? $19 million.

- Express Scripts has stashed over $54 million in offshore tax haven countries to avoid paying income taxes. If this practice was outlawed, it would have paid $19 million in federal income taxes.

20. Caesars Entertainment CEO Gary Loveman

Amount of federal income taxes Caesars Entertainment would have owed if offshore tax havens were eliminated? $15 million.

- Caesars Entertainment has stashed $42 million in offshore tax haven countries to avoid paying income taxes. If this practice was outlawed, it would have paid about $15 million more in federal income taxes.

21. BlackRock CEO Larry Fink

Amount of federal income taxes BlackRock would have owed if offshore tax havens were eliminated? $525 million.

- BlackRock has stashed $1.5 billion in offshore tax havens to avoid paying U.S. income taxes. BlackRock would owe an estimated $525 million in federal income taxes if its use of offshore tax avoidance was eliminated.

22. United Parcel Service (UPS) CEO D. Scott Davis

Amount of federal income taxes UPS would have owed if offshore tax havens were eliminated? $1.12 billion.

- UPS has stashed $3.2 billion in offshore tax havens to avoid paying U.S. income taxes. UPS would owe an estimated $1.12 billion in federal income taxes if its use of offshore tax avoidance was eliminated.

NOTE:*All data in this blog is re-posted from Sen. Barney Frank’s report, “Meet the Top Wall Street and Corporate Tax Dodgers” released on Feb. 7, 2013. View the full report and full list of 31 corporations here.

TAKE ACTION:

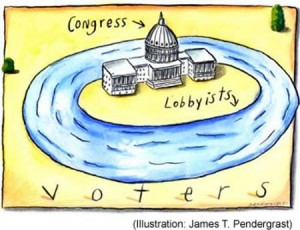

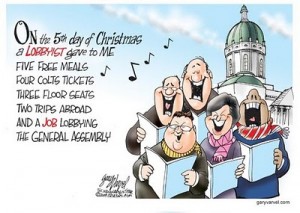

Sign Global Exchange’s petition to Congress demanding an action to assert that corporations are not people and money is not speech. Corporations should have to pay taxes like all the rest of us! All of the above unethical avoidance of fair and legitimate corporate taxes are made possible and ‘legal’ through the undue influence of corporate lobbyists floating to off-shore tax havens on a sea of money in politics. Stand up with us to get Money OUT and Voters in!

2012 certainly hasn’t been boring! Thanks to you and the hundreds of other people who are part of the Elect Democracy campaign, we’ve taken action to free our democracy from the moneyed grip of corporate interests… Thank you.

2012 certainly hasn’t been boring! Thanks to you and the hundreds of other people who are part of the Elect Democracy campaign, we’ve taken action to free our democracy from the moneyed grip of corporate interests… Thank you.

Stick It to Super PACs

Stick It to Super PACs •

•

TAKE ACTION

TAKE ACTION