Women and the War on Drugs

by Robin Lloyd

The following piece was originally published by Peace and Justice Newsletter of Burlington. The author, Robin Lloyd, is a filmmaker and peace activist from Burlington VT.

I first smoked marijuana when I was thirty years old. I found it to be more fun than alcohol. And more spiritual. It reminded me why I became a Quaker. It helped me see the inner light in people.

The next realization was that it was insane to make this simple plant illegal. In reading books on the subject I learned a surprising fact: the legal prohibition of cannabis, coca and poppy plants is determined at the highest level, not by God (since after all it is reported that Jesus used a cannabis extract in healing) but by the UN’s Single Convention on Narcotic Drugs of 1961. In 1970, Richard Nixon signed the legislation implementing national prohibition in compliance with the Convention: the Comprehensive Drug Abuse Prevention and Control Act.

So just to make that clear, US drug policy is determined by a United Nations Convention.

A potentially momentous reconsideration of that Convention will be taking place this April in New York City at the second United National General Assembly Special Session on Drugs (UNGASS).

I attended the first UNGASS in 1998 as part of the effort by the Women’s International League for Peace and Freedom (WILPF) to change policy and especially to assert our position that ending the war on drugs is a women’s issue.

Why? There are many things wrong with this War – its racism, its reliance on military solutions – but one not frequently mentioned is its impact on women.

The War on Drugs condones a form of macho violence. In earlier decades, that violence was played out between cops and robbers, then cowboys and Indians, and now the DEA and narco traffickers.

The War allows men to find an excuse to be violent and to militarize societies. Women lose in time of war, no matter what George Bush says. And what are the results of criminalizing a natural human desire to change consciousness? A massive international slush fund of illegal money funding brothels, gun running, bribes, and casinos: all endeavors that are not much fun for women.

The legal enforcement of prohibition leads to racism and punitive incarceration. On the supply side, the chaos caused when Latin American governments, bullied by the US, agree to spray farmers’ land to destroy coca crops – without asking their permission of course – in the middle of a civil war, has been an ongoing environmental tragedy and political disaster.

I accompanied a WILPF delegation to Colombia in 1996 and documented our meetings with the courageous but melancholy victims of the war: women heartbroken that their sons were forced to join a paramilitary group to kill other women’s sons who had joined the guerillas. A high point of our visit was a meeting with the secretary of the Small Coca Farmers Cooperative. Olmyra Morales arrived at our meeting at a human rights center in Bogota carrying a small suitcase. Like an Avon door-to-door saleswoman, she set out the healing lotions and teas made from he coca plant and described their beneficent uses.

A year later, WILPF US, under the leadership of executive director Marilyn Clement, got a grant from the Drug Policy Foundation for a US tour of women survivors of the War on Drugs: North and South. Olmyra came from Colombia, joining a coca farmer from Bolivia and Peru and an African-American former cocaine addict who was HIV positive – Marsha Burnett from Montpelier VT.

On one of the stops on the tour we met with the staff of a anti-drug abuse program in Baltimore. It was an amazing but gentle confrontation between women who grew the crops whose product was destroying the communities in the inner city of Baltimore, and those who had to deal with the effects of this epidemic. Who was to blame? Who was ‘evil’? New insights were gained that day.

The next year Olmyra came back to the US to testify at the first UNGASS on Drugs in 1998, sponsored by the Transnational Institute from the Netherlands. She and Marsha Burnett were chosen from amongst civil society participants to address (from the balcony) hundreds of diplomats making up the UN Committee of the Whole. They spoke as victims of the supply and demand side of this war.

They held hands aloft and said “We together, representing the two criminalized extremes of the drug problem, say that we are united in seeking a sustainable way of life for our communities…”.

It was moving to hear poor women speaking the truth in those august halls. But did anyone really listen? What was the outcome of that first UNGASS? Titled “A Drug-Free World — We Can Do It!”, President Clinton cajoled the rest of the world into increasing the military response to drug use. The US government was happy to assist Latin American countries in acquiring high speed motor boats for interdiction and low cost loans to build prisons for drug offenders (and anyone else who offended the state).

A lot of drugs have passed under the bridge since that time. This April, UNGASS II will take place in a much changed atmosphere. According to the Transnational Institute, UNGASS 2016 is an unparalleled opportunity to put an end to the horrors of the drug war and instead prioritize health, human rights, and safety.WILPF’s attempt to speak truth to power before UNGASS 1 was a low profile, grassroots effort. By contrast, this April, survivors and victims of this war, north and south, will be traveling as part of a much more robust caravan, starting in Honduras, to present their case to the UN. Sponsored by Global Exchange, with a large grant from George Soros’s Open Society, this movement for freedom from government oppression has a chance to be a game changer.

To follow the Caravan, and for information on UNGASS, please go to http://www.globalexchange.org/programs/caravan-peace-life-and-justice. For info on the film Courageous Women of Colombia, visit www.greenvalleymedia.org.

Last Monday, elected officials in Congress were called by constituents to follow up. Dozens of participants

Last Monday, elected officials in Congress were called by constituents to follow up. Dozens of participants  TAKE ACTION:

TAKE ACTION:

TAKE ACTION

TAKE ACTION

As we set our sights on the next 25 years, with your support we will reform U.S. gun laws, force Hershey’s to go Fair Trade, and continue to oppose unjust policies in the U.S. and abroad.

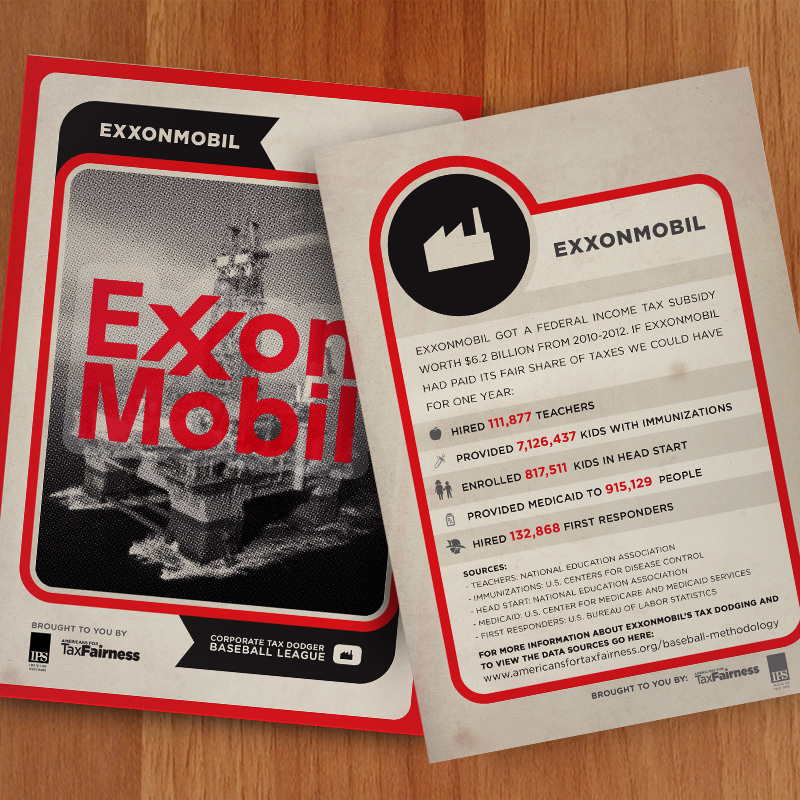

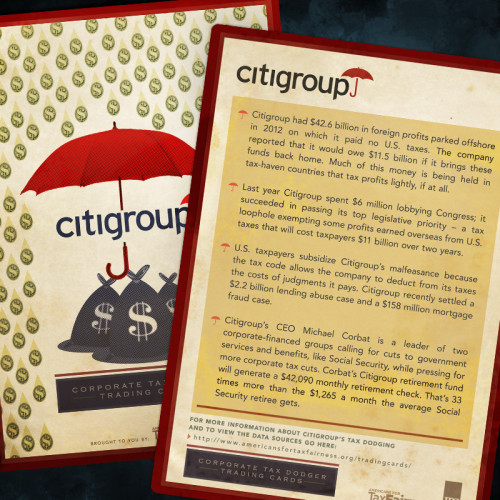

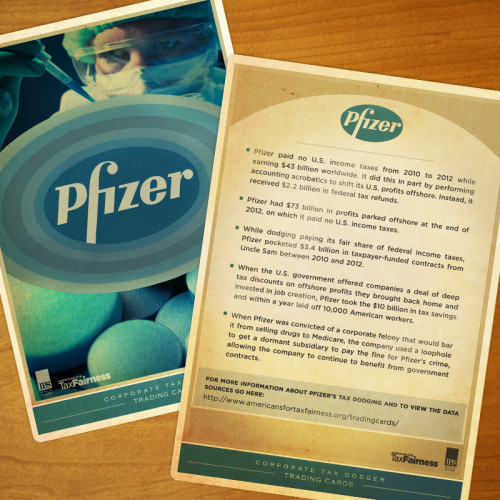

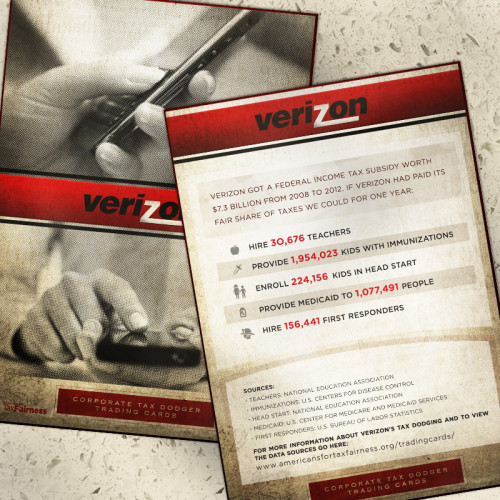

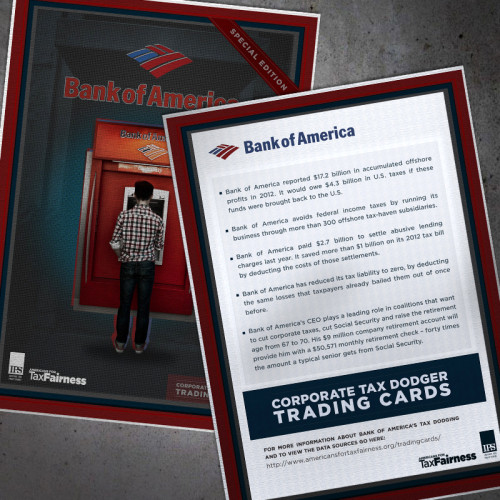

As we set our sights on the next 25 years, with your support we will reform U.S. gun laws, force Hershey’s to go Fair Trade, and continue to oppose unjust policies in the U.S. and abroad. 2012 certainly hasn’t been boring! Thanks to you and the hundreds of other people who are part of the Elect Democracy campaign, we’ve taken action to free our democracy from the moneyed grip of corporate interests… Thank you.

2012 certainly hasn’t been boring! Thanks to you and the hundreds of other people who are part of the Elect Democracy campaign, we’ve taken action to free our democracy from the moneyed grip of corporate interests… Thank you.

Stick It to Super PACs

Stick It to Super PACs •

•